Types of Fractional Property Investment

Office Buildings

Commercial buildings designed for office spaces, typically housing businesses, corporations, and professional services.

Retail Spaces

Properties used for retail businesses, including shopping malls, strip malls, standalone stores, and storefronts.

Industrial Properties

Facilities used for manufacturing, warehousing, distribution centers, logistics, and industrial operations.

Multifamily Properties

Apartment complexes, condominiums, and residential buildings with multiple units that are primarily used for rental purposes.

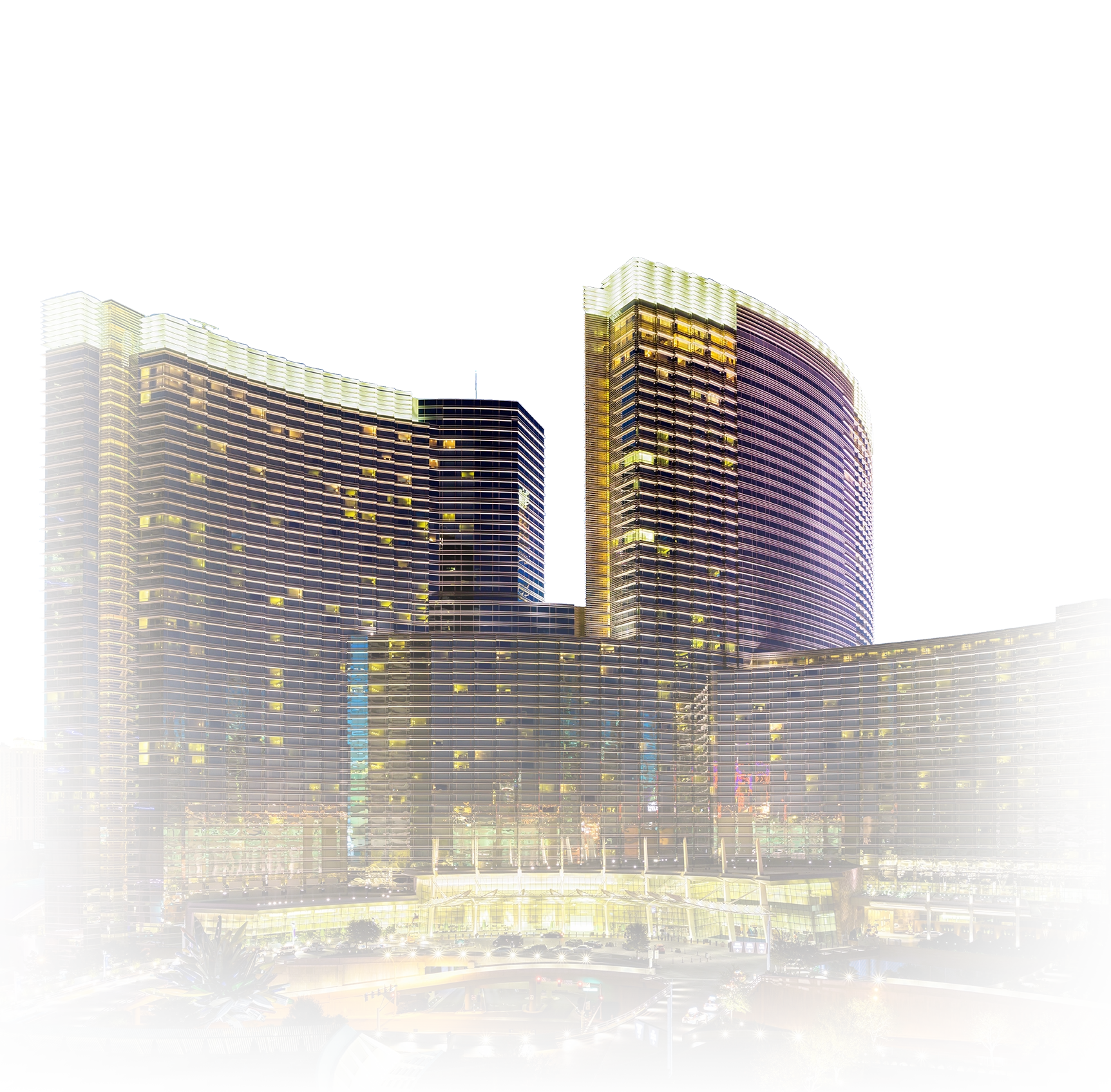

Hospitality

Hotels, resorts, motels, and other accommodations designed to cater to travelers and tourists.

Mixed-Use Developments

Properties that combine multiple uses, such as residential, commercial, and retail spaces in a single development.